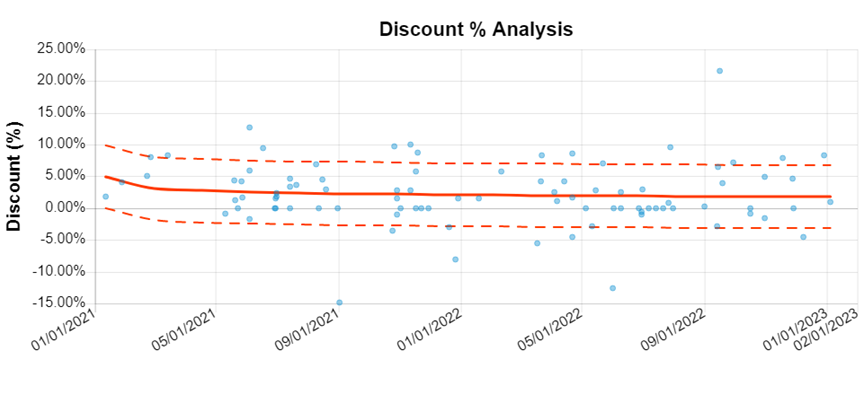

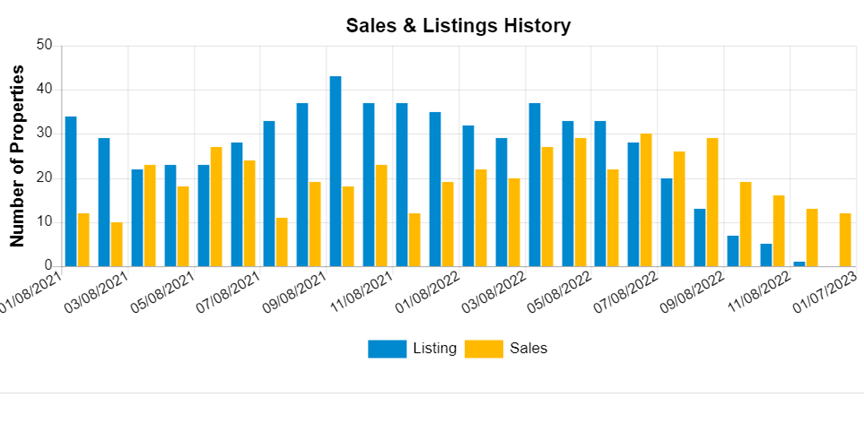

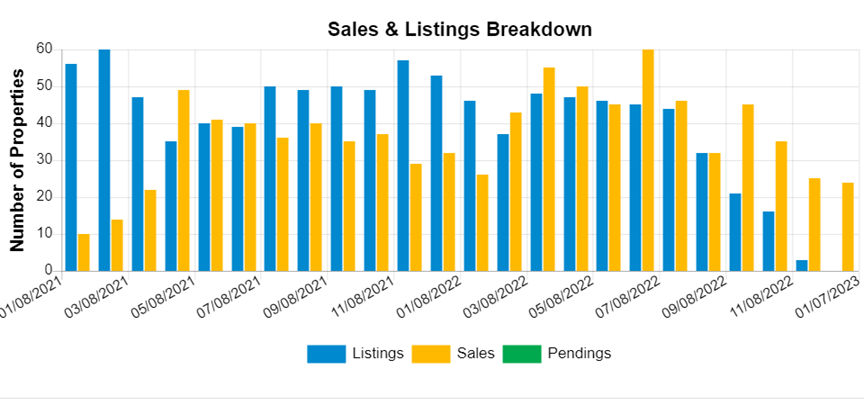

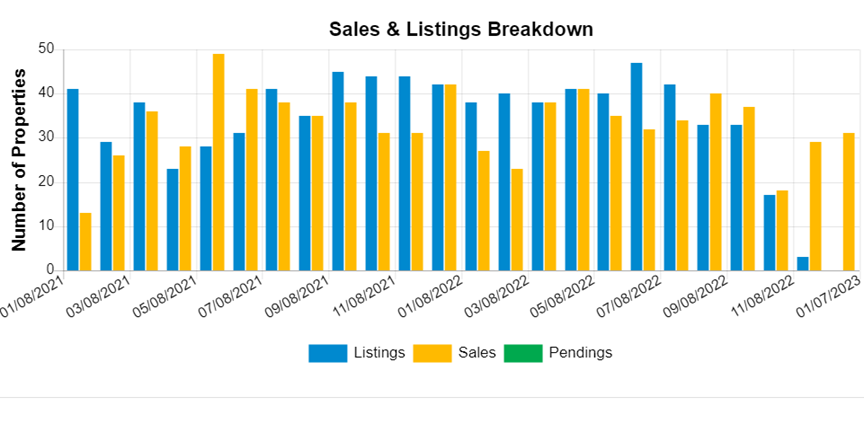

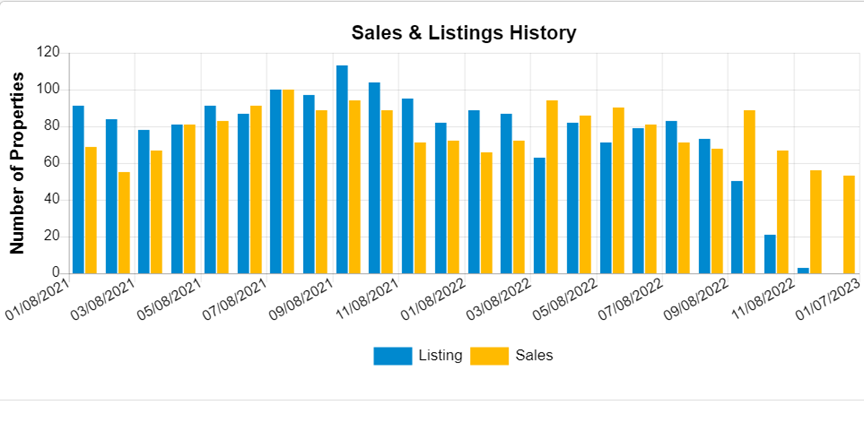

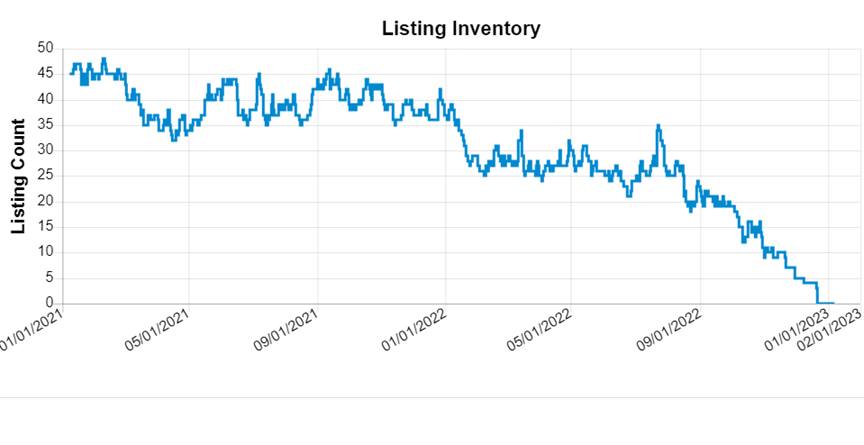

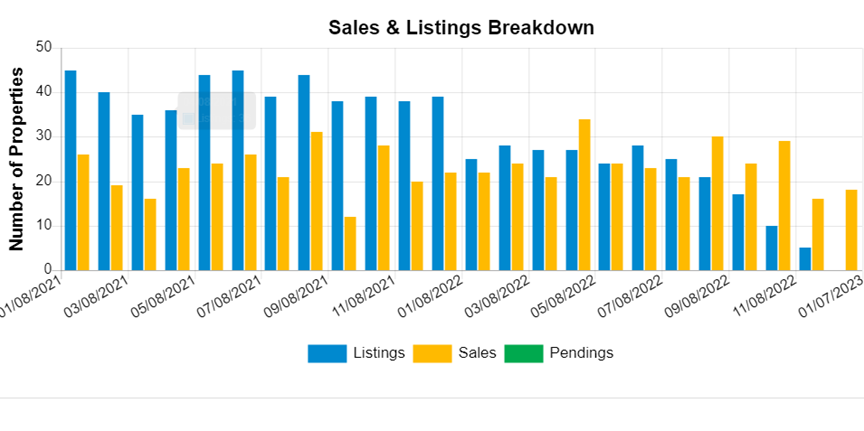

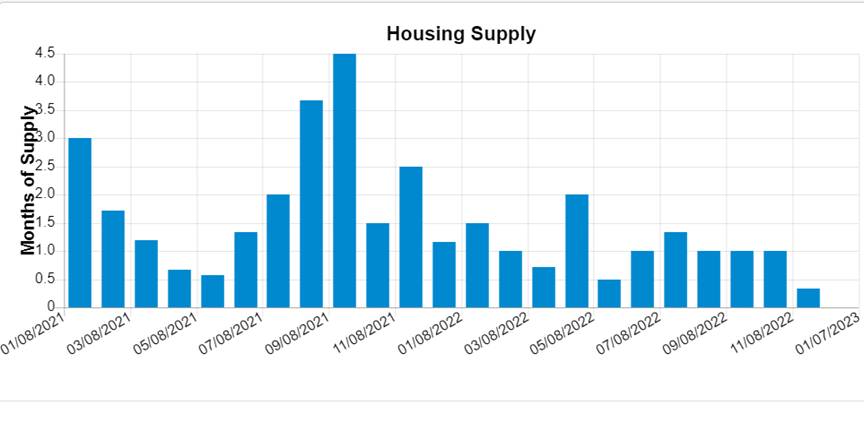

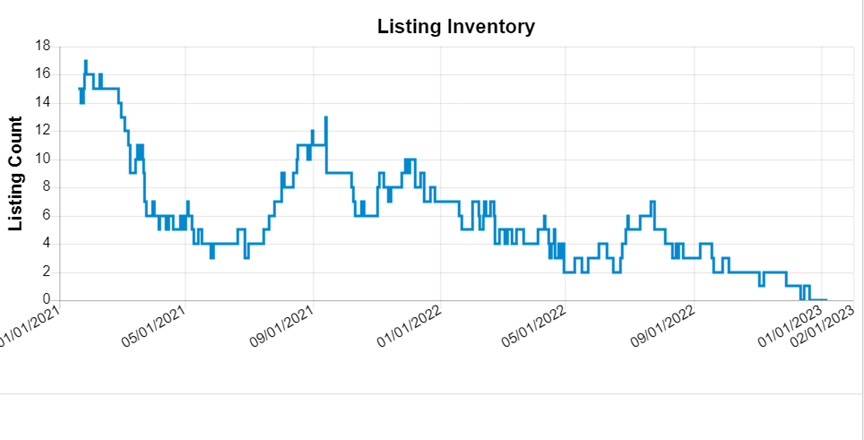

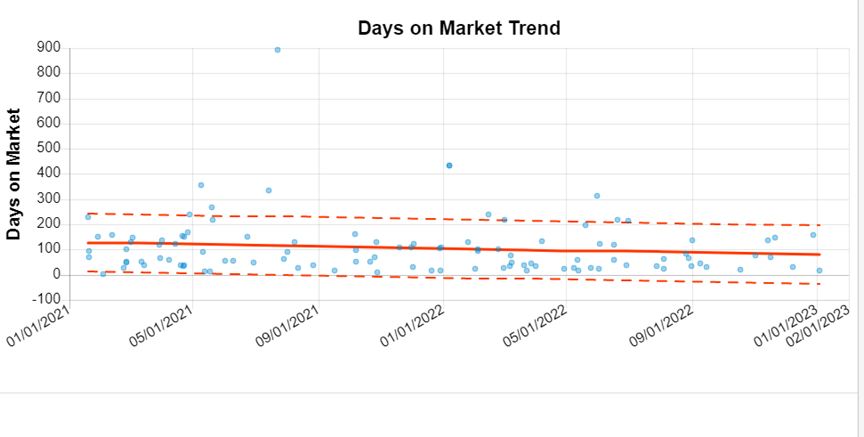

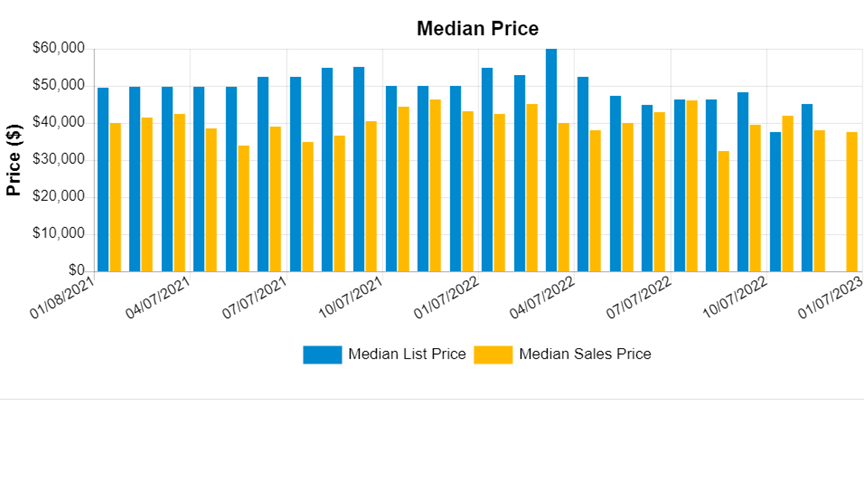

I am often asked whether or not the market is crashing. I would answer yes, the market is crashing, well….sort of. New listings are crashing (usually happens this time of year), but so are marketing times. Sales are down but list to sales price is up. What does this mean? It means there is STILL shortage of inventory. Why you ask? It is possible that the high level of home buying activity in the past year may have temporarily reduced the pool of potential buyers AND sellers. Also, so many refinanced at such low rates during the covid pandemic, it would be hard to think that many would make a move in the foreseeable future. Low mortgage rates can make it more affordable for homeowners to stay in their current homes and can reduce the incentive to sell and move to a new home.

2008 vs 2023

The most striking contrast between the present recession and that of 2008 is the state of housing credit. In 2008, the foreclosures and bankruptcies that arose served as a warning of the impending job loss recession. However, today’s story is vastly different. Loose lending, adjustable-rate mortgages which led to sudden high monthly payments, and 0 money down loans are not the major factor when the economy went belly up in 2008. Homeowner equity is at the highest level it’s been in the past several decades as well. Credit scores are areoverall up over the past 12 years. Hale expects U.S. home prices to rise by 5.4% this year, while Morgan Stanley is forecasting a 7% drop from the peak in June 2022.

Still, many economists agree that a housing market crash like the one we experienced in 2008 is highly unlikely. The factors that caused home prices to plunge during the Great Recession—specifically lax lending standards and a surplus of inventory—aren’t prevalent in our current market.10 Therefore, home values are expected to remain comparatively stable.

‘Are the foreclosures here yet?’ ‘When do you think we begin to see foreclosures hitting the market?’

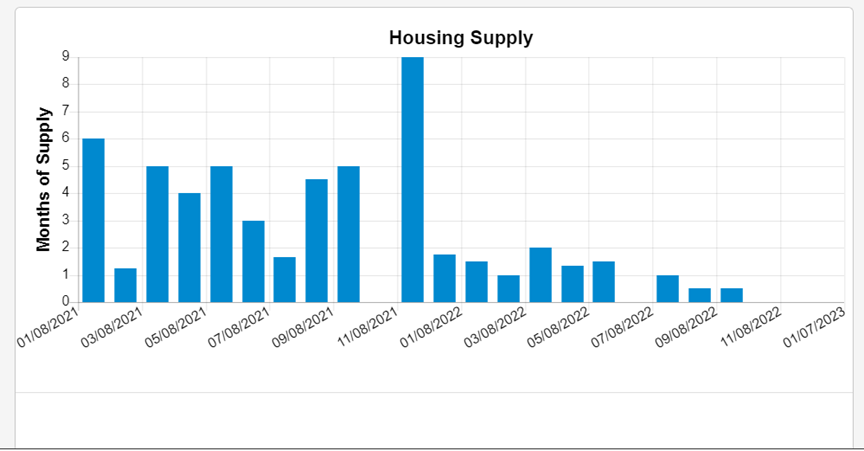

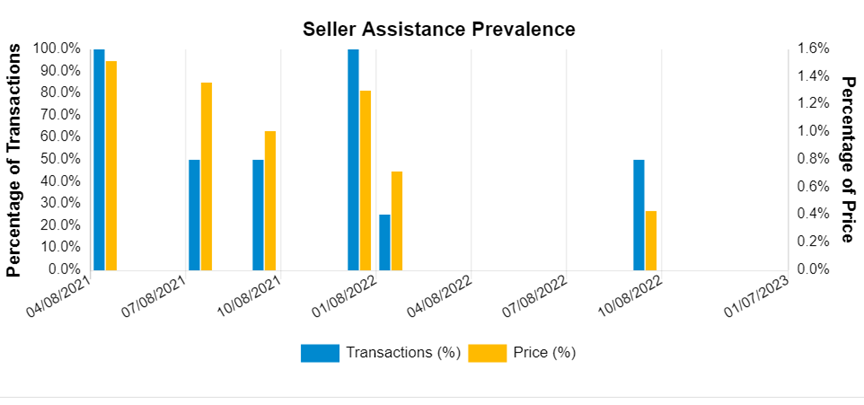

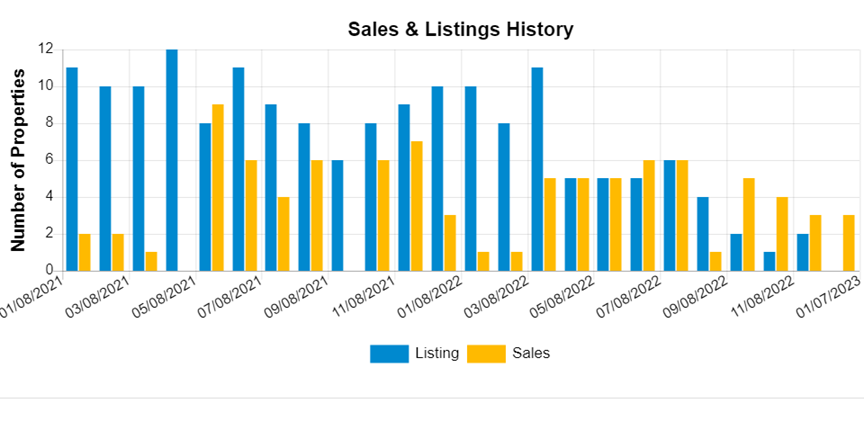

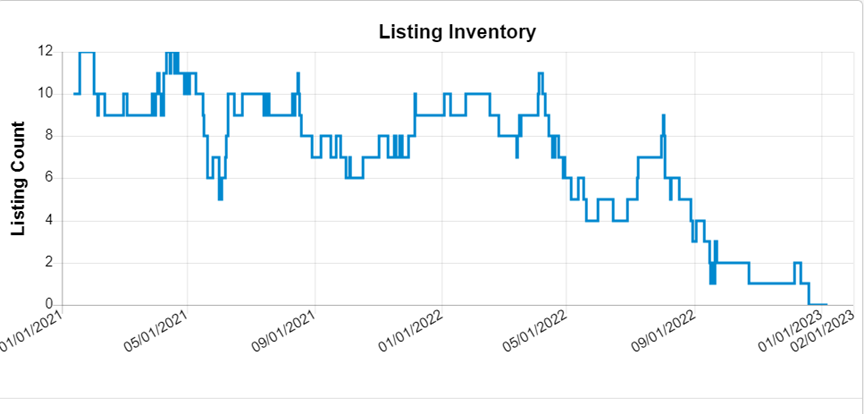

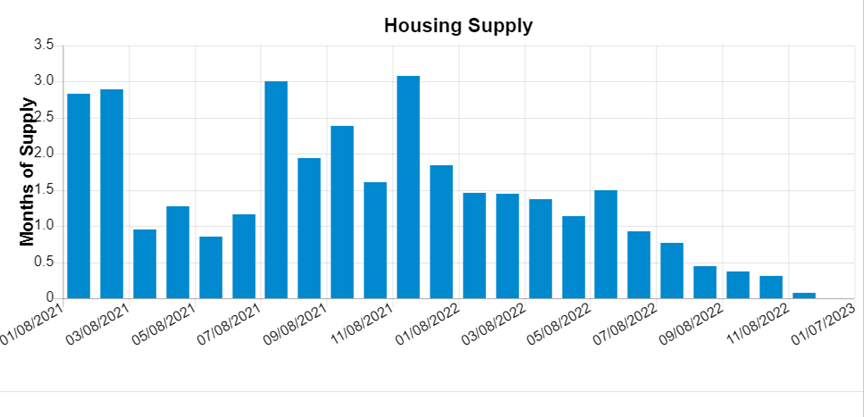

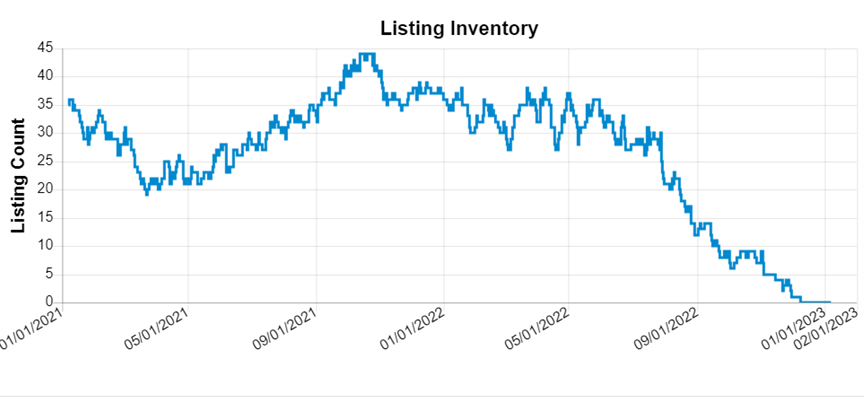

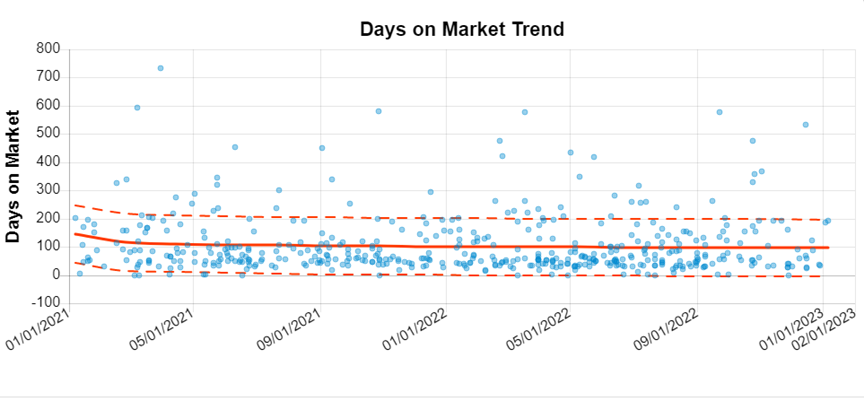

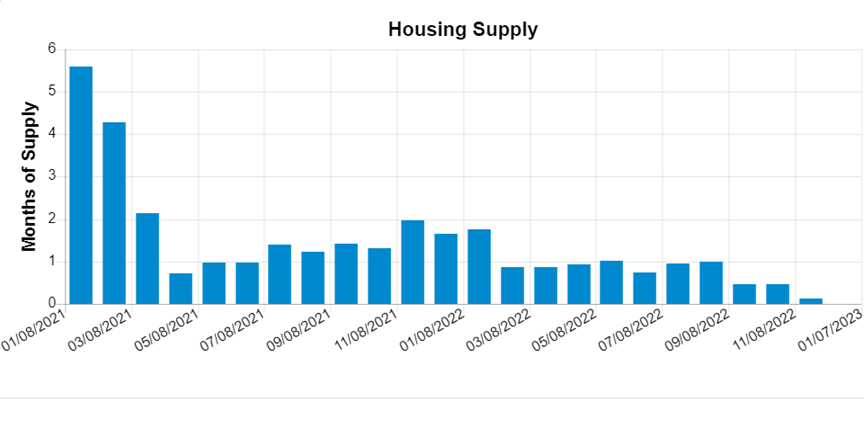

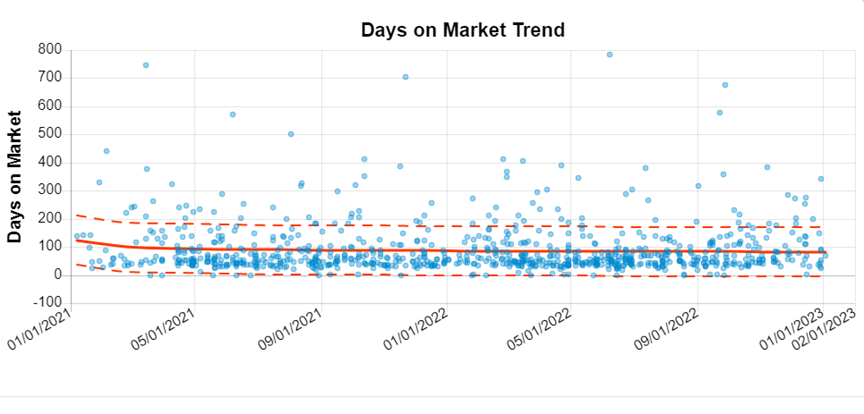

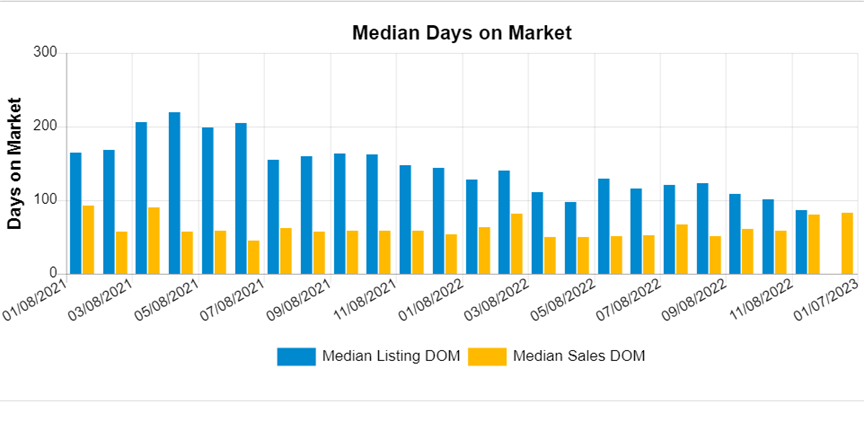

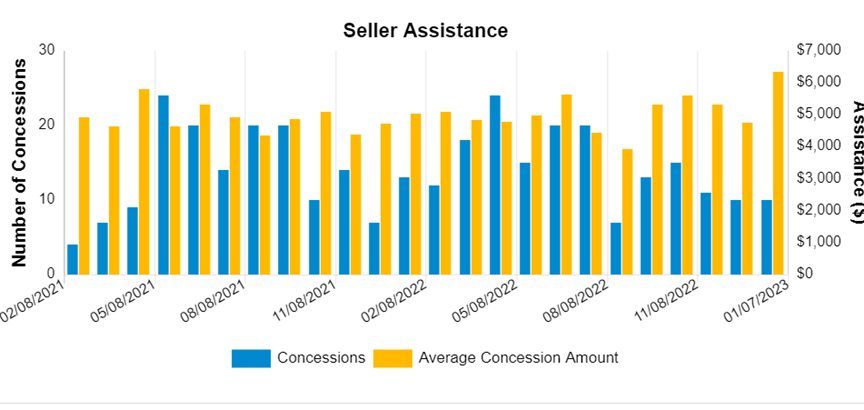

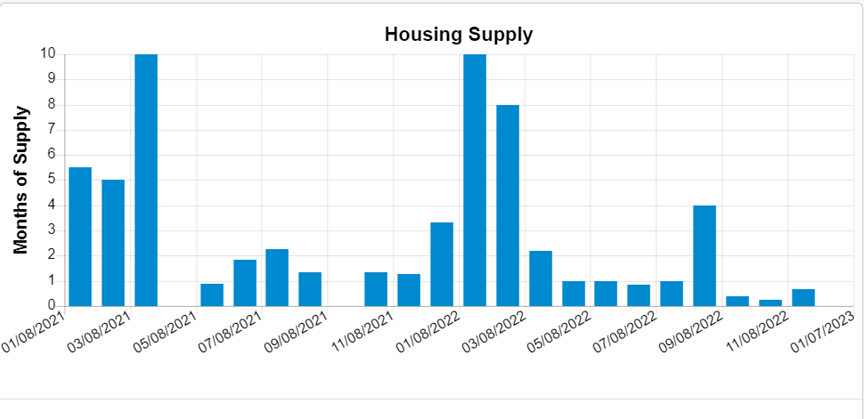

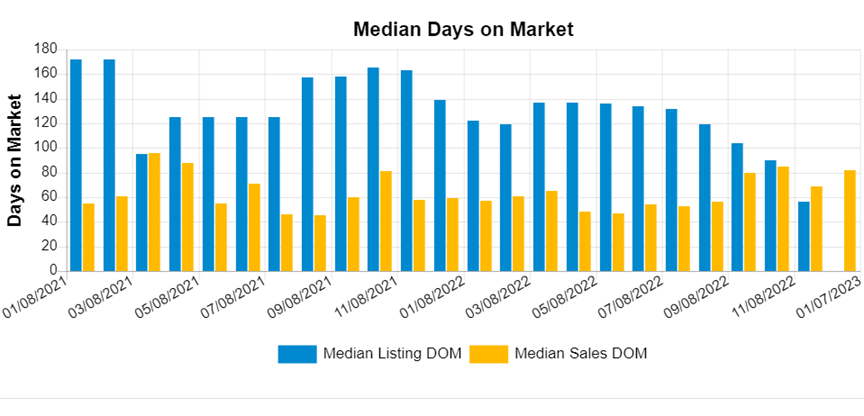

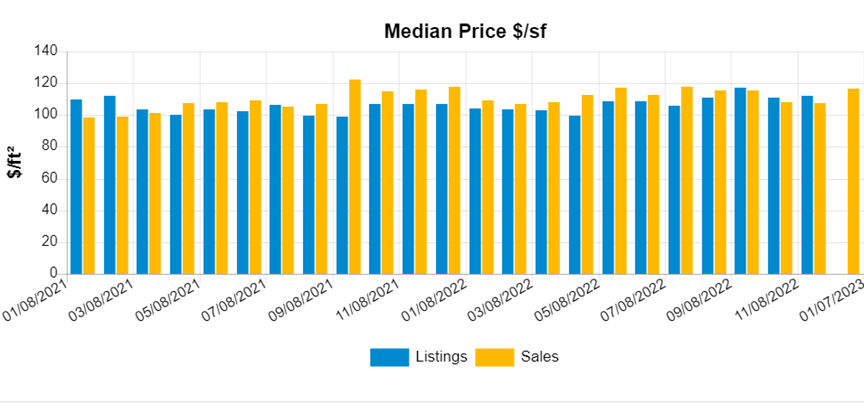

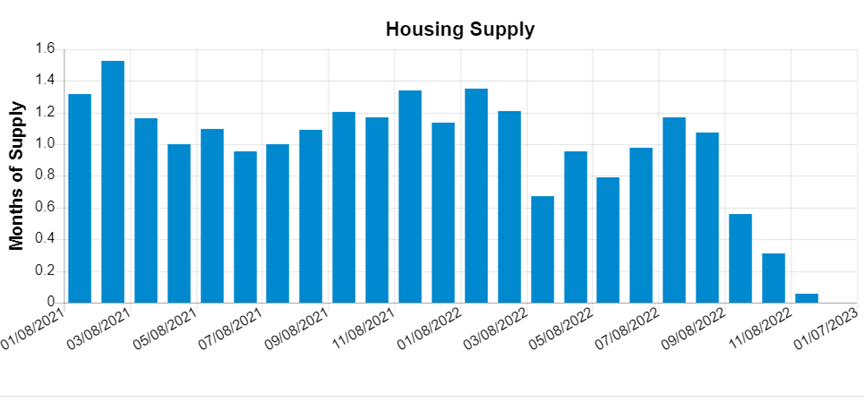

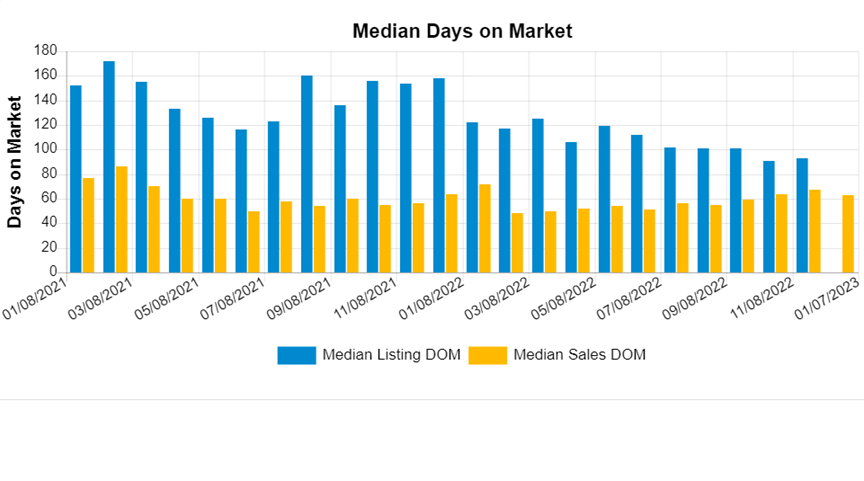

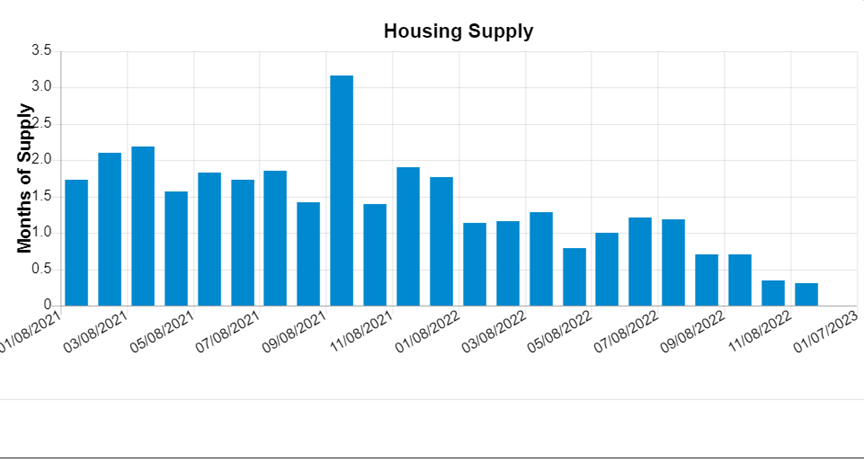

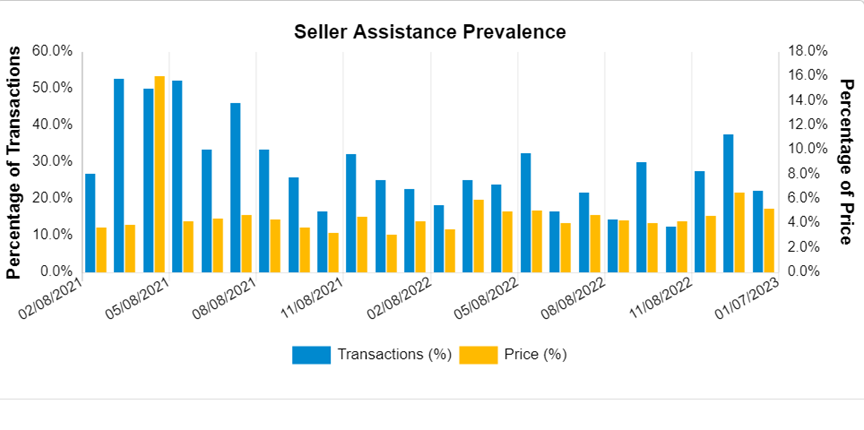

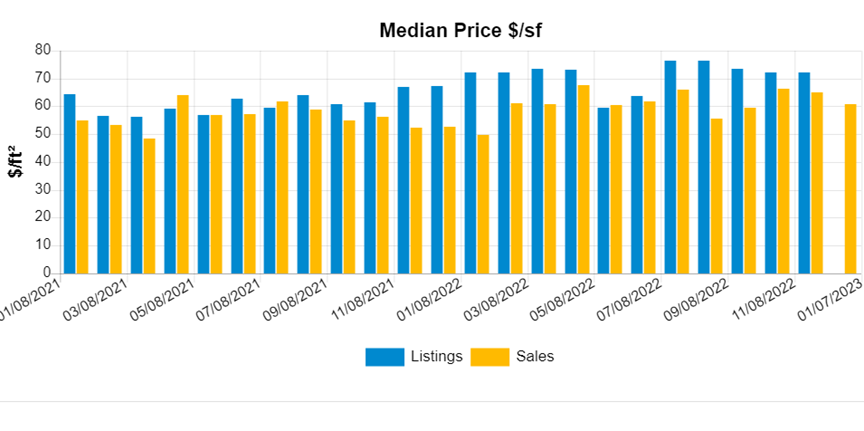

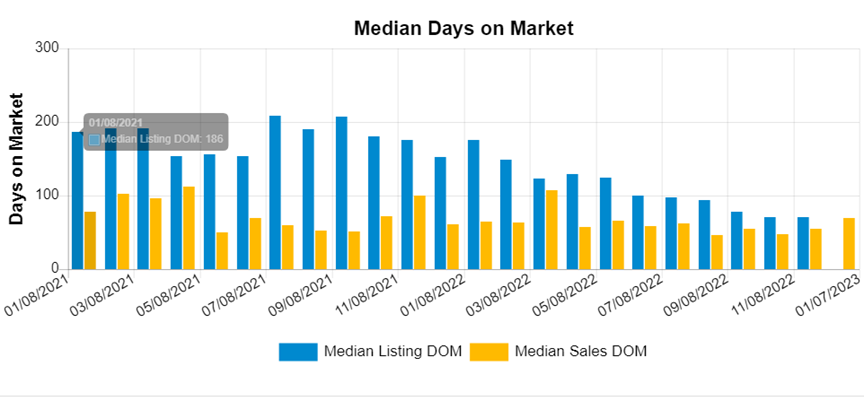

It is difficult to predict exactly how it will evolve over time because the housing market is influenced by many factors and can change rapidly, however, at the present time, it appears there are a pool of buyers in every property value segment that are willing to pay more than they did even 3 months ago. The market has been slowly increasing in terms of value, but sharply decreasing inventory. Note that in the following charts, there are some small changes that may signify the market pulling in a different direction but also not it is January and is those changes are typically normal for the 1st quarter.

If you’ve been frustrated by a lack of inventory in the past, later 2023 may bring new opportunities for you to find the perfect home. And today’s buyers have more negotiating power than they’ve had in years. Call us today @ (662) 523-4603 for a consultation!

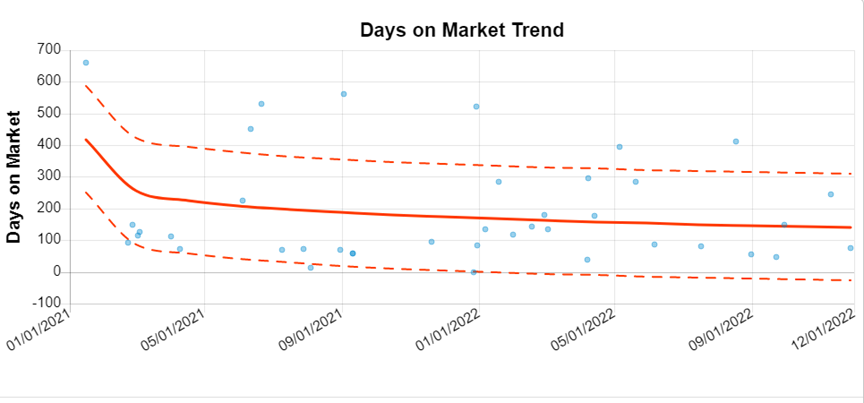

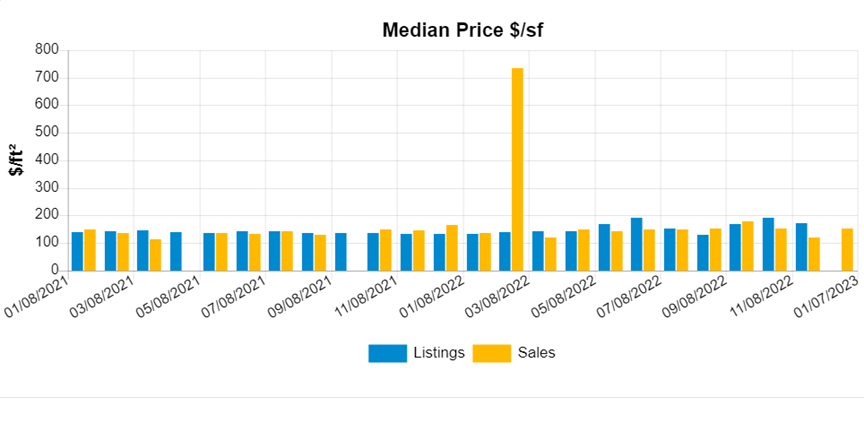

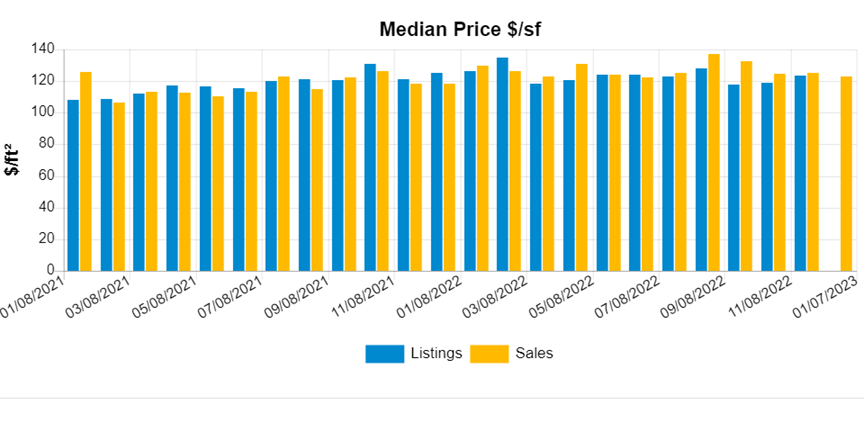

Let’s start with sales prices of $700,000 to $1,000,000. It is clear that overall price per sf in the segment is increasing despite low inventory. Days on market is decreasing, list to sales price ratio slightly increasing.

Slight uptick in list to sales price ratio

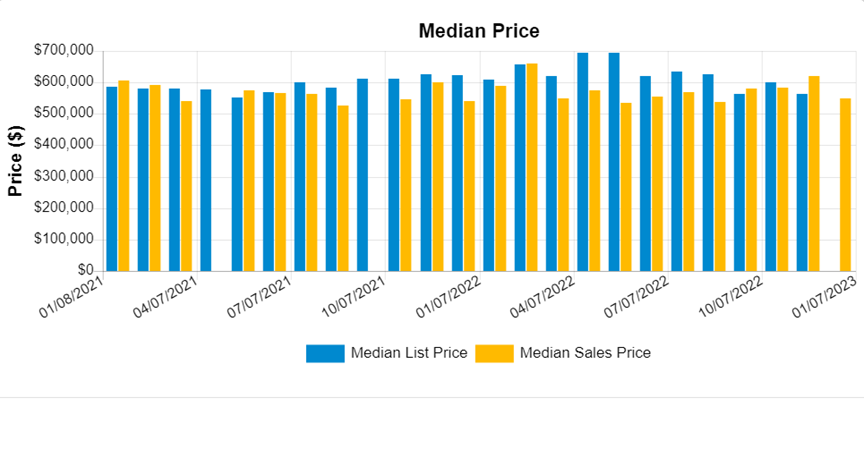

$500,000 to $700,000 Range

Price Per Sf slightly up

Median price somewhat steady

Listings down, sale absorption rate up

List to sales price ratio slightly down. Although fewer sales, there is a lack of Inventory in this price range putting upward pressure on sales prices

$325,000 to $500,000

Small Decrease in Exposure Time on the Market

$230,000 to $350,000

Again, similar to the other housing supply segments

Significantly more sales than listings with past several months

$185,000 to $235,000

Although a decreasing housing supply, within this price range, it is has been less significant until recently as shown below

A slight but steady increase in price per SF

$95,000 to $185,000

Sharp decrease in housing supply within the past 3 months

$50,000 to $95,000

$30,000 to $50,000 – Cash Dominated Sales

As demonstrated, all of these market price segments have several common undeniable trends. Low and decreasing housing inventory, increasing list to sales price ratio, decreasing days on market, increasing price per sf and sales prices. Although, there are many more factors to consider in appraisal, this overall macro value show significant enough trends in each market segment to determine that we are still in Northeast Mississippi are in the midst of a housing shortage with a pool ready buyer. However, finding willing sellers is the current challenge facing the market in 2023.

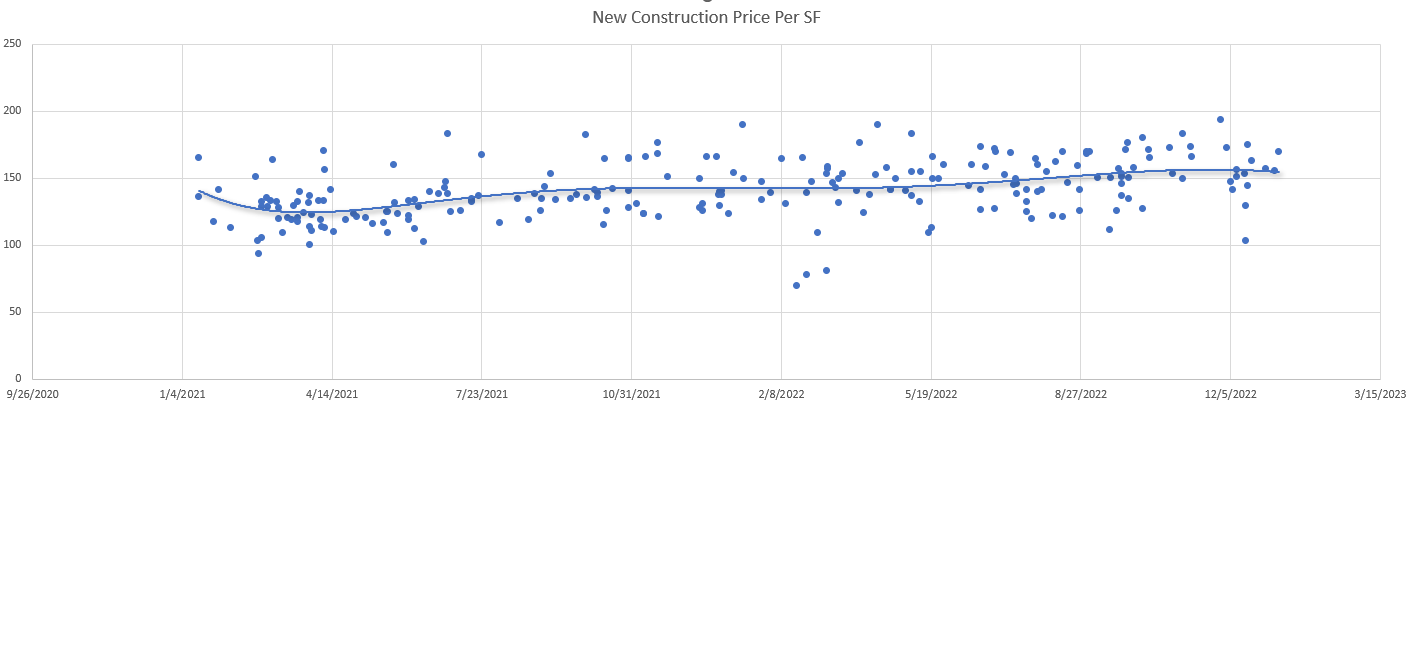

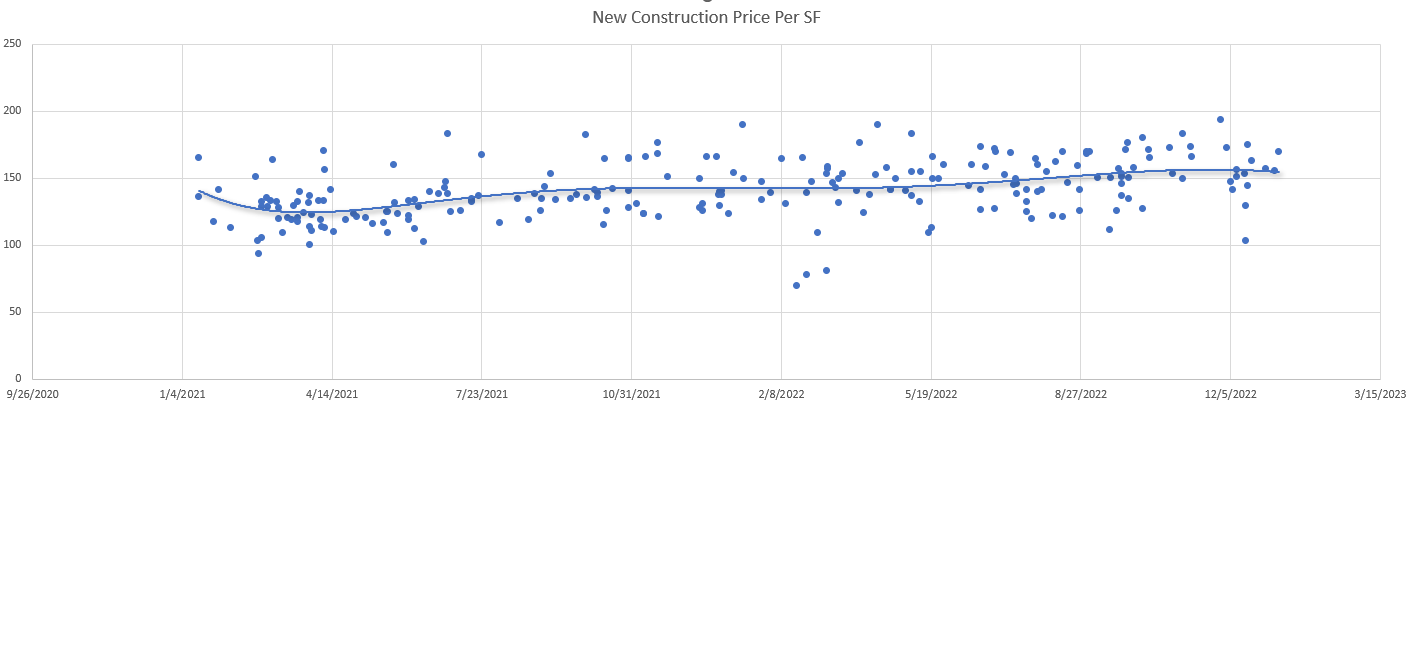

This should all help with builders in the near future and evidently is now as shown below. We should also an increase in multifamily starts.

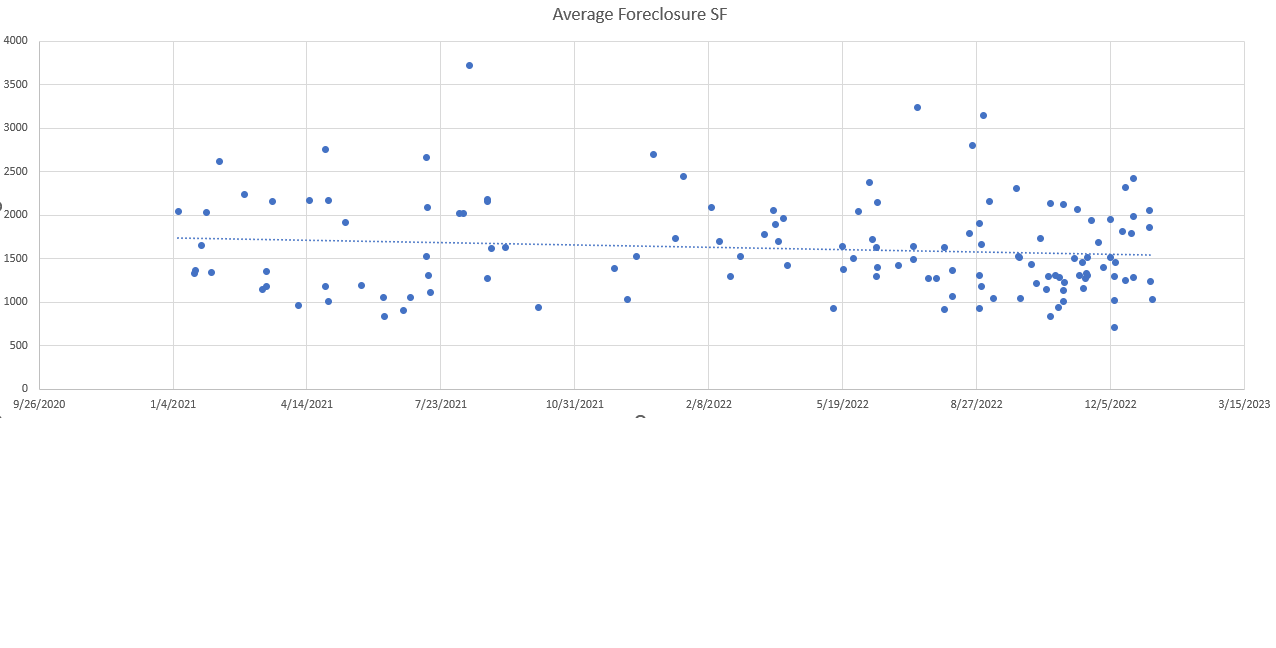

Of some interest, in the above chart that average per sf of foreclosed homes in the area has been trending downward.

In conclusion, listings are crashing but the prices are not due to a pool of willing buyers with few sellers willing to sell. Time will tell whether this changes, but there are no significant statistical signs showing it will in the near future. In my opinion, the market will eventually reach a state that is more in an equilibrium in 2023.

Call us today @ (662) 523-4603 for a consultation!