Pontotoc County Mississippi Soil Types and History

Pontotoc County Soil Types and History

In the northern part of Mississippi, Pontotoc County is a place bursting with geological history and agricultural potential. The soils here, shaped over millions of years, give us a fascinating peek into the past and provide a rich foundation for the future.

Here are a few soil types in Pontotoc County Mississipi

Loam and Clay Soils

Uses: Highly fertile, perfect for farming. Ideal for crops like cotton, soybeans, corn, and sweet potatoes.

Proportion: 25%

Sandy Soils

Uses: Great for construction because they drain well and provide a solid foundation.

Proportion: 20%

Silty Soils

Uses: Easy to work with and excellent for farming due to their ability to hold nutrients and water.

Proportion: 20%

Bentonite Clay

Uses: Holds water well and provides essential minerals, beneficial for farming and conservation efforts.

Proportion: 15%

Timber Soils

Uses: Ideal for growing timber, supporting the growth of hardwood and pine trees.

Proportion: 20%

Here’s a detailed view of the different soil types and their uses in Pontotoc County:

The Geological Backbone

The soils in Pontotoc County are part of the Ripley Formation, which dates back to the Late Cretaceous period, about 70 to 100 million years ago. This formation includes layers of sand, silt, and clay. Among these layers, scientists have found bentonite clay, which comes from ancient volcanic ash. This clay helps us understand old volcanic activities and climate conditions. (This means we can learn about ancient volcanoes and what the environment was like millions of years ago.)

Composition and Formation

The Ripley Formation is a significant geological structure within the Gulf Coastal Plain, stretching across several states in the southeastern U.S. It’s mainly made up of marine sediments from when the area was covered by a shallow sea. These sediments turned into rock over time.

Sand: These layers are fine to medium-grained with ripple marks and cross-bedding, showing they were deposited in an active environment with currents and waves. (This tells us the sands were moved and shaped by water long ago.)

Silt: Finer than sand, silt settled in quieter waters like lagoons or deeper parts of the ancient sea, indicating calmer periods. (This means the silt settled in calmer waters.)

Clay: Particularly important because it contains bentonite from volcanic ash, this clay records volcanic activity and its impact on the climate. Bentonite is also valuable for its high water absorption and swelling properties. (This means the bentonite clay tells us about past volcanoes and is useful today.)

Volcanic Ash and Bentonite Clay

Bentonite clay formed from volcanic ash that settled millions of years ago. This ash, from distant volcanic eruptions, was carried by wind and water to the area. Studying bentonite gives us several insights:

Volcanic Activity: Bentonite layers show periods of significant volcanic activity. (We can learn how often and how big ancient volcanoes were.)

Climatic Conditions: Volcanic eruptions affect the climate by blocking sunlight and cooling the Earth, and studying ash layers helps reconstruct past climate conditions.

Sediment Transport: By studying minerals like zircon in the bentonite, geologists can trace the origins and paths of these sediments. (We can understand where the sediments came from and how they moved.)

Research and Applications

Research on the Ripley Formation, like the work by Elizabeth Jayne Vitale, helps us understand the origins and transport pathways of sediments, helping piece together the region’s geological history. These studies help us understand geological processes and the connections between different regions.

Bentonite clay is not just scientifically significant but also useful in various industries. Its high water absorption makes it great for drilling mud in oil and gas exploration, binding foundry sands, and making cat litter. It’s also used in environmental applications like landfill liners due to its ability to absorb contaminants.

Agricultural Significance

The soils of Pontotoc County are the backbone of the local agricultural community. The region’s soil, enriched with minerals from its geological past, supports a variety of crops. The fertile loam and clay soils are ideal for growing cotton, soybeans, corn, and sweet potatoes. Bentonite layers improve soil health by retaining water and providing essential minerals that help plants grow.

Farmers benefit from the natural fertility of these soils, reducing the need for artificial fertilizers and promoting sustainable farming practices. The county’s agricultural output supports the local economy and contributes significantly to Mississippi’s overall agricultural productivity. (Farmers can grow more crops naturally, helping the economy and the environment.)

Suitability of Soils

Different soil types in Pontotoc County are suitable for various uses:

Loam and Clay Soils: Highly fertile, perfect for farming. These soils are great for crops like cotton, soybeans, corn, and sweet potatoes. (These soils are very good for growing crops.)

Sandy Soils: Great for construction because they drain well and provide a solid foundation. These soils are less fertile for crops but excellent for building structures. (These soils are good for building because they don’t hold water.)

Silty Soils: Easy to work with and excellent for farming due to their ability to hold nutrients and water. (These soils are great for growing a variety of plants.)

Bentonite Clay: Holds water well and provides essential minerals, beneficial for farming and conservation efforts. (This clay helps improve soil health and is useful for various environmental purposes.)

Timber Soils: Soils with a good mix of sand, silt, and clay, often found in well-drained upland areas, are ideal for growing timber. These soils support the growth of hardwood and pine trees, making them suitable for the timber industry. For building and construction, stable, well-drained sandy and loamy soils are preferred as they provide a solid foundation and reduce water retention issues.

Environmental and Conservation Efforts

Understanding the geological and agricultural aspects of Pontotoc County’s soils is crucial for environmental conservation. Soil erosion, degradation, and nutrient loss are challenges that can affect the land’s long-term viability. By studying the soil, scientists and farmers can develop better management practices.

A Glimpse into the Past, a Resource for the Future

The soils of Pontotoc County are a testament to the region’s rich geological history and agricultural potential. From ancient volcanic ash to fertile fields, these soils are both a window into the past and a resource for the future.

Pontotoc County Mississippi Soil Types and History Read More »

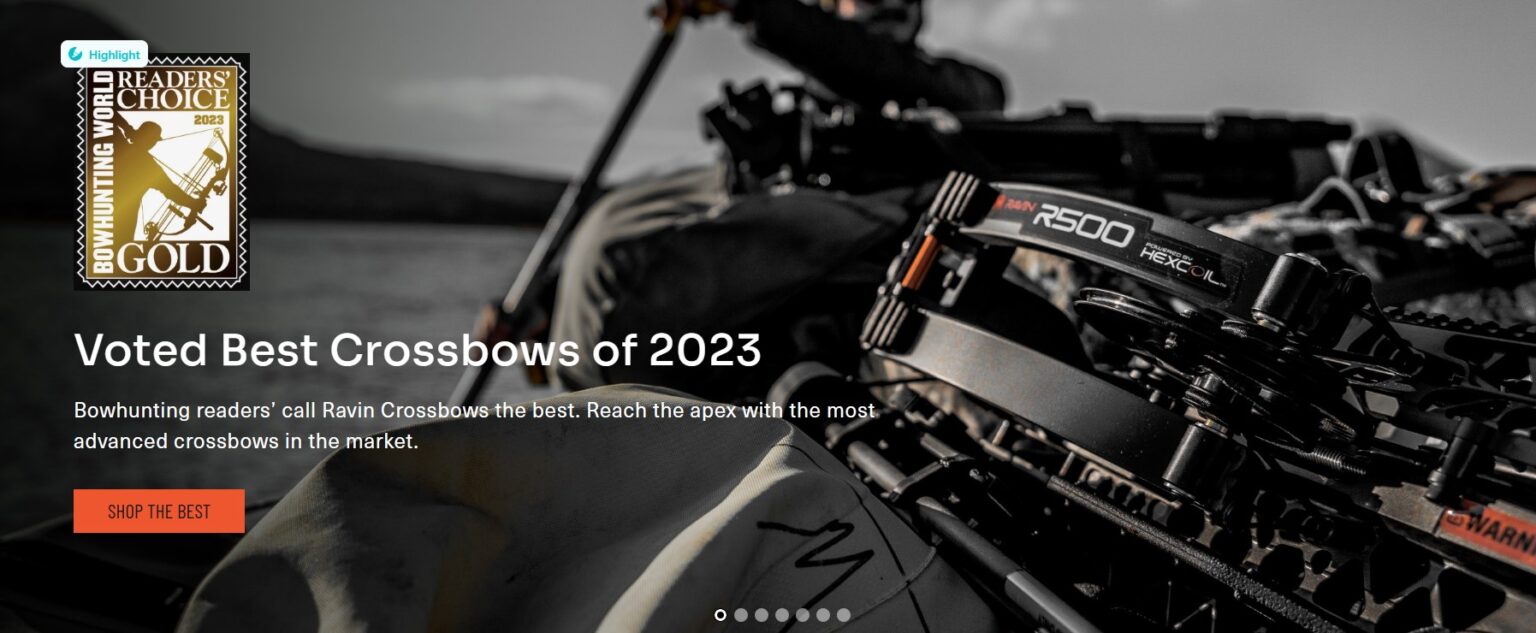

From Quiet Corner to Market Square: Maximizing Your Land Sale Potential

From Quiet Corner to Market Square: Maximizing Your Land Sale Potential